by Dr. Cindy Briggs

If you have ever thought of starting a business, you may have done a little research and found so many articles that start listing off the things you need to do (I have been guilty of creating some of those articles/posts). One day, I had a very brave client say to me, “I don’t know what you mean by that.”

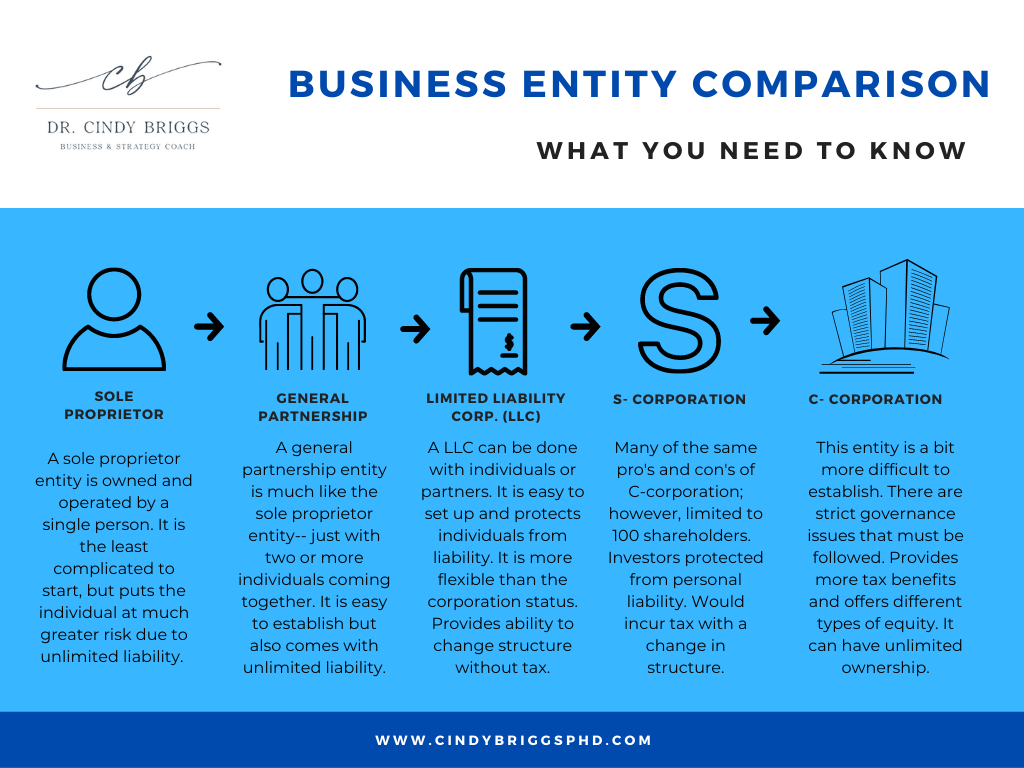

I stopped and thought…. “we are only on point number three!” After you have determined your product/service, and then landed on a name… you will then need to determine a legal business. This means you have to decide what kind of entity you want to be. You will have to decide if you want to be a sole proprietor, or an LLC, or a corporation. Your head may be spinning right now, and you may decide to walk away because this just seems so difficult. Well stay with me….

I want to break this down and make it as simple as possible.

First, WHERE will you need to put this information?

- It will be required when you fill out your individual state paperwork (another post)

- You will also put it on your IRS documents (again, another post)

It is a necessity and you want to get it as “right” as possible the first time.

I created a downloadable chart (below) that gives you a brief overview of all of the types. Let me stop here for a minute to tell you that MOST OFTEN I recommend my small business clients to form an LLC. It is fairly easy, it protects your individual assets, and it fits with most businesses.

I still want to give them to you– and explain a bit about each. These are standard definitions/explanations that you will find on most sites helping individuals start a business.

TYPES OF ENTITIES

- Sole Proprietor: A sole proprietor entity is owned and operated by a single person. It is the least complicated to start, but puts the individual at much greater risk due to unlimited liability. Yes, if something goes wrong… someone can sue you individually. I have seen some very small, at-home businesses start in this model– but I do typically advise changing.

- General Partnership: A general partnership entity is much like the sole proprietor entity– just with two or more individuals coming together. It is easy to establish but also comes with unlimited liability. This really is just a sole proprietor with more than one person. Still putting each person at personal risk, and doesn’t offer any great tax benefits.

- Limited Liability Corporation (LLC): A LLC can be done with individuals or partners. It is easy to set up and protects individuals from liability. It is more flexible than the corporation status. Provides ability to change structure without tax. Also, allows pass-through tax status which means that profits are only taxed once.

- S-Corporation: Many of the same pro’s and con’s of C-corporation; however, limited to 100 shareholders. Investors protected from personal liability. Would incur tax with a change in structure. This status is a bit of a “mix”. You are taxed like a partnership (so you can avoid double taxation).

- C-Corporation: This entity is a bit more difficult to establish. There are strict governance issues that must be followed. Provides more tax benefits and offers different types of equity. It can have unlimited ownership. You will want this entity if you are going to look for many investors, of if you want to go public (sell stock on stock exchange).

It is always important to talk with an accountant to determine your individual tax needs, etc. As I mentioned, more often than not– I steer people to the LLC. You will check your individual state’s guidelines to make this happen.

I hope this helped you have a better understanding of each type of entity and why you might want one over the other. Let me know if you have any other questions.

Dr. Cindy Briggs is an entrepreneur, author, speaker, college professor, wife and mom. Her mission is to provide programs that can help entrepreneurs and communities thrive. To find out more, visit www.cindybriggsphd.com.